Banks hold a large share in consortiums of lenders across nations worldwide. Traditionally, banks, owing to their large size have remained as the last man to join the bandwagon whenever there is a new technology in comparison to their relatively new counterparts like fintech companies. The reasons can be plenty in the past, and some of them were valid. But a continuation of this attitude towards technology will hamper the speed at which digitization needs to match solution-thirsty processes and consumer demand for quicker disbursal of loans.

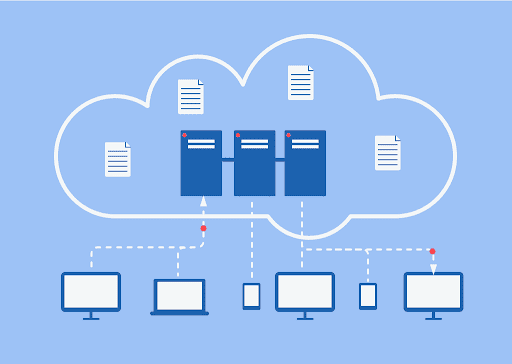

Driving efficiency to speed up the process of a loan cycle will depend on the interface and the features that will be part of the digital tools. One such tool is available in the form of eVault solutions that offer a secure platform for lenders to store eNotes and other important related documents and aid in faster closings. We are at the threshold where it is pragmatic for lenders to leverage industry-trending integrations to offer a secure, streamlined, efficient, and compliant digital mortgage process.

Electronic vaults are innovative tools that can be availed through a service provider’s platform which can be easily synced to the existing workflow system. The entire integration will not take more than a couple of working days and sometimes even hours and can help in enhancing the user experience of the digital loan products. It finally equates to a faster processing timeline for the loan applicant with fewer errors, and yet is a cost-effective approach. Considering the many advantages that eVault provides to the digital loan stakeholders, it is a good idea to check some out:

-

As Secure As You Wish It Was

Just the way a traditional promissory note is safely kept in a strong room, an eNote is securely protected in an electronic repository or an eVault. The eVault can interact with the MERS® eRegistry without loss of data or any breach because of the multi-layer encryption. The registry maintains the data of all the eVault providers, so there is no way that anyone can scam a person or an establishment.

-

Data Transfer

Lenders can access the eNotes preserved in eVault faster than actual paper-based promissory notes that have to be extracted from a physical warehouse. This leads to expedited service as someone looking to pay up a loan does not have to pay for extra days as in the past when the loan stayed on the books till the documents were accessible.

-

Less Cost

Physical storage in a secure place costs are higher as there are overheads such as the rent of the space and the salary of the security personnel. Such costs are done away with eVaults as the subscription cost of the service provider is a fraction of the physical premises.

Conclusion:

Adding eVault to the features of the digital loan products will increase the credibility of the lender as they are taking an extra step to keep the data secure and provide a complete end-to-end cycle for a digital mortgage instead of a piecemeal solution.