In Today’s Online financial world, managing debt efficiently and properly is critical for banks, financial institutions, and NBFCs. The Tallyman Axis is a newly launched platform for debt management and recovery, Managing payments, and scheduling payouts. Designed by Experian, this software is responsible for many financial activities in Axis Bank and other financial institutions.

Tallyman Axis Login is a portal launched by Axis Bank for its customers to manage payments, Debt management, and recovery dashboards for Axis Bank employees and third-party vendors.

This article will explore Tallyman and its integration with Axis Bank and how Tallyman Axis is used for efficient debt management and collection. We will also discuss the Tallyman Axis login and account creation process, its features, and its benefits for small to medium businesses.

What is Tallyman Axis

Tallyman is a sophisticated debt management, collection, and recovery platform developed by Experian. It is specifically designed to streamline and ease the process of handling debt collection challenges. The platform also enables banks like Axis Bank to optimize their debt recovery strategies while ensuring quick response and regulatory compliance.

Existing Axis Bank vendors and users can use the Tallyman Axis Bank Login to log into their existing Tallyman Axis account to check debt profiles, submit or export reports, analyze their monthly expenses, and make payroll. The platform is very similar to Get_Ready_Bell:Client_Pulse but for banks, It lets you track real-time debt collection and recovery data from the Axis portal itself.

Tallyman Axis Login: How to access your Tallyman Account?

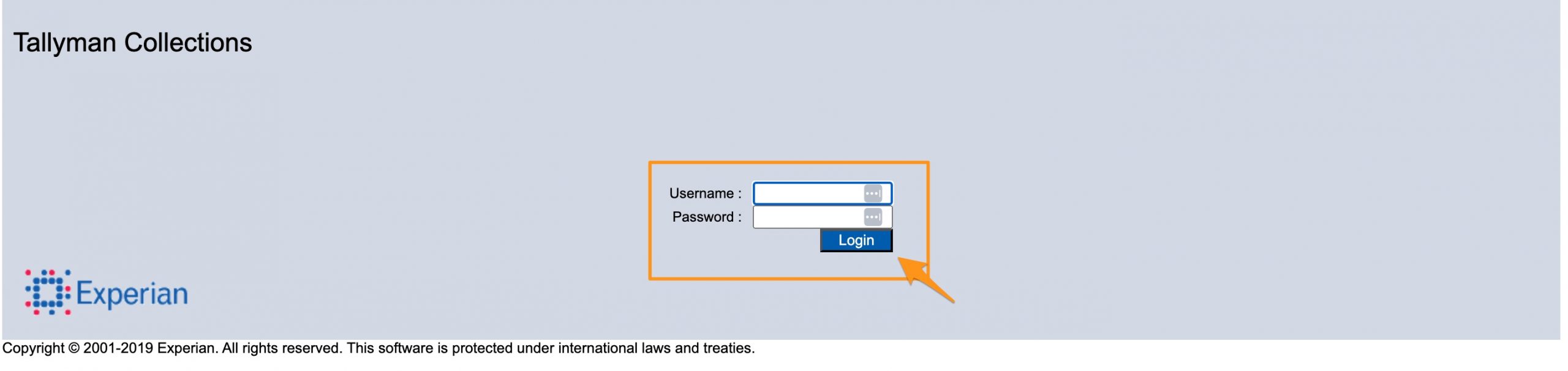

The Tallyman Axis login offers an easy-to-use interface for Axis Bank’s team and other vendors to access the platform and manage their tasks efficiently. With a secure authentication system, one needs to have an account with a designated login and password to access the Tallyman Axis account.

For anyone who is looking to access Tallyman, Please go through your email to find the login credentials for your Tallyman axis account and then follow these steps:

Step 1: Go to the official Tallyman Axis Login Page

To access your Tallyman Axis Login page, visit https://collections.axisbank.co.in/collections/ and enter your login details. If you see a blank page, click the popup icon near the URL bar and click the button that says “Always allow popups and redirects.”

Step 2: Enter Username and Password

When you click the Allow popups option, you will be redirected to a new screen to log into your Tallyman axis account directly. Enter your username and password in the fields and click the “Login” button.

Step 3: Verify Identity

Once you enter the correct username and password, you will be redirected to a screen where you will be asked to verify your identity by confirming a link sent to your email or entering the OTP sent to your registered mobile number. If you don’t receive any of the following verification links, please contact the Experian Tallyman team to solve the issue.

Also Read: 1TamilMV Proxy Unblock

Registering your account on Tallyman Axis

Registering for a Tallyman Axis account is not direct as there is no official registration form available. You will need to perform multiple verification steps, such as User verification, KYC, identity verification, etc., before you can get your login credentials. Here are the steps to open your Tallyman Axis account.

- Visit your nearest Axis Bank branch.

- Submit your documents to the bank manager in your area.

- Submit additional information (If required).

- Complete your KYC verification (For Indian customers)

- Once the process is complete, you will receive your Axis Collections login details via Email.

That’s it! Once your account is successfully registered with Tallyman Axis, Follow the steps given above to log in to your account.

Benefits of using Tallyman Axis

Now that you know the registration and login process to access your Tallyman Axis account, Let’s see the benefits of using Tallyman Axis.

1. Improved Efficiency

Automating tasks like debt collection, client confirmation, and other routine tasks can significantly reduce time spent on manual processing, Thus allowing employees and customers to focus on other manual tasks.

2. Better Customer Insights

The Tallyman platform is known to offer more than 100+ data points on a single customer, making it the most insightful tool for any financial institution. Tallyman provides deep insights into customer behaviors, enabling bank employees to make the right decisions regarding debt collection and repayments.

3. Enhanced Recovery Rates

Tallyman Axis provides the right tools required for the quick recovery of debts. With advanced reminders of payments to confirm the payment and close the account, the Tallyman axis can automate every task for you. With the help of Tallyman, Banks like Axis Bank have already seen improved recovery rates.

Conclusion

Tallyman Axis is a perfect platform for managing debt and automating complex processes to get actionable insights and enhanced customer experience. The Tallyman Axis portal is a one-stop solution for managing and recovering debt.

Though the login process is simple, if the Tallyman login page is not loading properly, you might need to refresh the page or use the VPN.